Feature Release: Take Profit / Stop Loss Orders for Futures Manual Trading

Bitsgap's futures manual trading just got a major upgrade with the addition of Take Profit and Stop Loss orders. Say what?! Now, before you start jumping for joy, simmer down and keep reading!

Say hello to our ultimate tool designed to help you snatch up those sought-after profits and keep those pesky losses at bay. Get ready to meet the Take Profit/Stop Loss for futures manual trading!

Isn't it just the most frustrating thing when you can't set up Take Profit and Stop Losses on your futures manual trades? We're betting you've been yearning for this feature. Well, your wishes have not fallen on deaf ears! We've heard your calls loud and clear, as we always do, and we've put our noses to the grindstone to make it happen.

So, roll out the red carpet for the latest sensation in town — a brand-new feature baked to perfection for all you futures fanatics — Take Profit/Stop Loss for futures manual trading. It's fresh, it's exciting, and it's all set to revolutionize your trading game!

Let’s see how it works and how you can start benefiting from it now.

What Is Take Profit/Stop Loss for Futures Manual Trading?

Let's break it down in the simplest terms: Take Profit (TP) is your golden ticket to locking in and banking profits from a successful trade. On the other hand, Stop Loss (SL) is your safety net, a point at which your trade idea doesn't stand up to the test, prompting you to close your trade at a loss to prevent your portfolio from taking a severe hit.

Now, you've been enjoying the Take Profit/Stop Loss options on Bitsgap for spot market since forever (along with a whole host of other amazing advanced options, naturally). But we're about to amp up the excitement — now you can also harness these risk management powerhouses in futures trading!

👉 If you’re scratching your head over the difference between spot and futures trading, we think you should read this primer first: Spot Trading vs Futures Trading in Crypto

Benefits of Setting Up TP/SL for Futures

Why, you might wonder, should I bother with those nifty TP/SL orders?

See, trading is all about playing the odds. Entering trades with no exit plan in mind is a recipe for disaster. Especially considering the liquidation at stake when it comes to futures. Not only could it lead to a rapid drain of your funds if your speculated scenario doesn't pan out, but it could also pave the way for stress and emotional decision-making.

That's why many traders choose to automate and preset their take profit and stop loss levels as soon as they enter a trade.

Pinpointing Stop Loss and Take Profit levels can significantly sharpen your trading strategy. By doing so, you'll know exactly how much money you stand to lose if the trade doesn't go as planned, and you'll also know exactly how much money you'll pocket when closing the trade.

This invaluable insight can not only help you judge the rationale of a trade but also assist you in forecasting your portfolio growth curve in the future.

How Do You Set Up TP/SL for Futures Manual Trading on Bitsgap?

👉 Pressed for time? Check out the video below for a speedy step-by-step guide:

Setting up Take Profit/Stop Loss is a breeze! Let us guide you through this simple process:

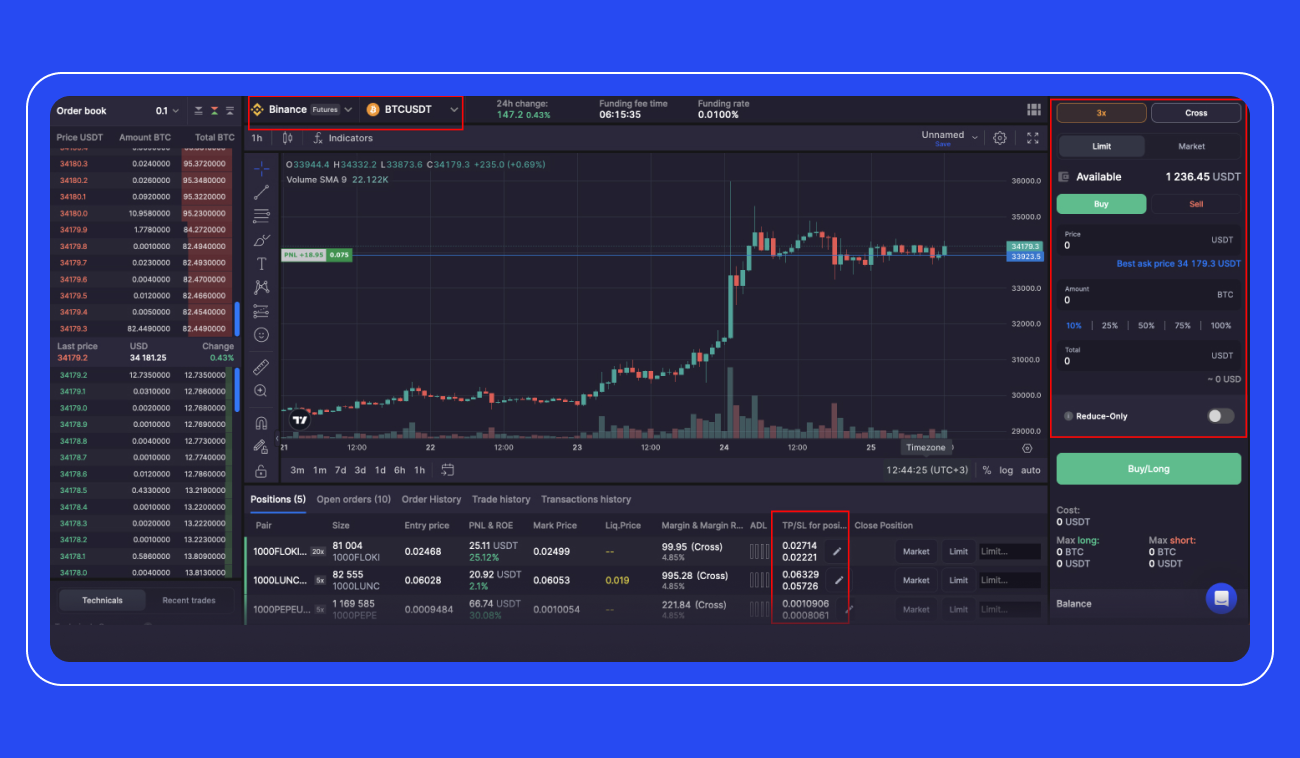

- Start by clicking on the [Trading] tab at the top of the interface. Select Binance Futures and pick your preferred trading pair just above the chart.

- To the right of the chart in the manual trading order placement window, select your leverage, type of margin (Cross or Isolated), order type (Limit or Market), direction of trade (Long or Short), and set your investment amount. Then, hit [Buy/Long] or [Sell/Short].

- If you opted for Limit, hang tight until the order appears at the interface's bottom in the [Positions] section. If you selected Market, you're now ready to set up TP/SL.

- If you'd like to set TP/SL, simply click on the TP/SL section to add those orders.

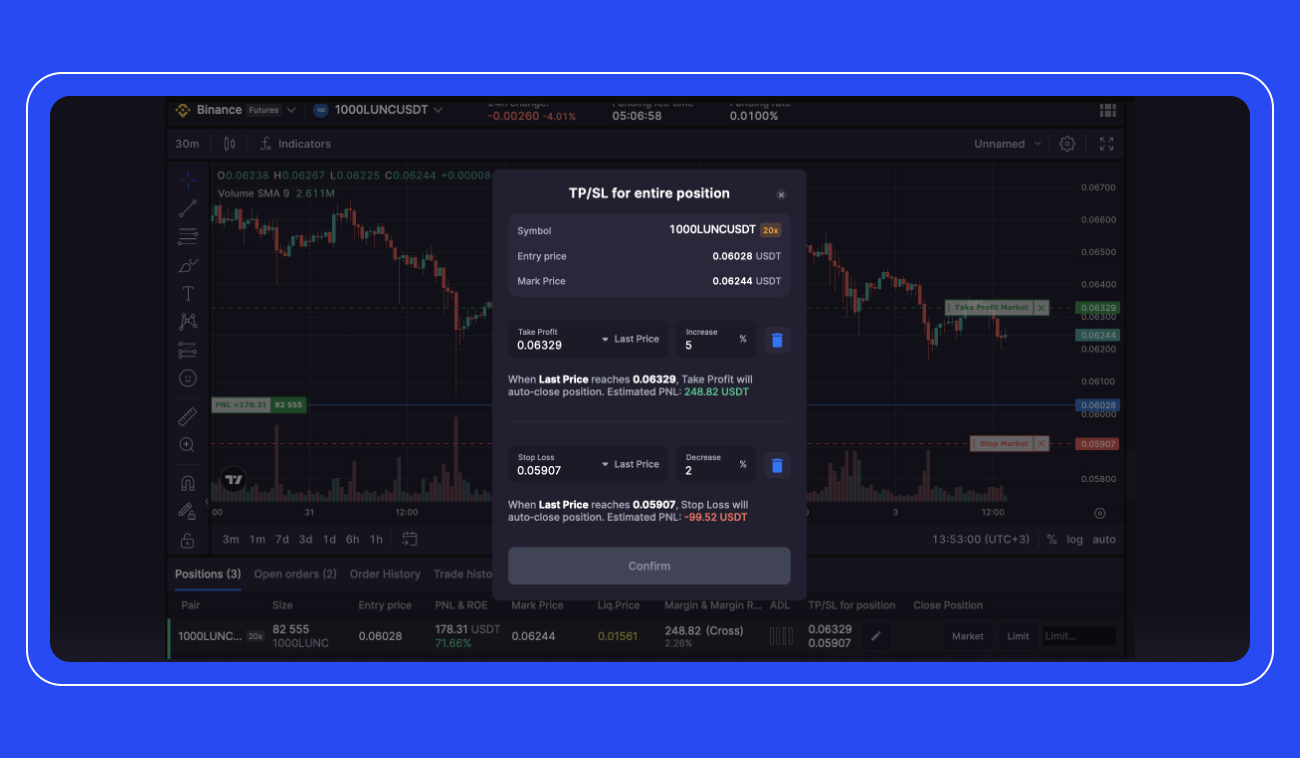

- Upon clicking the TP/SL menu, you'll see a pop-up window (Pic. 2). Here, you can specify either a percentage or a desired value for Take Profit/Stop Loss orders. You can choose between two types of prices — “Mark Price” or “Last Price.” If you opt for “Mark Price,” you'll base either or both of the orders on the estimated fair value of a futures contract. If you choose “Last Price,” the orders will be based on the most recent trading price of a futures contract. Remember, Stop Loss and Take Profit orders are designed to auto-close your entire position. A Market order kicks into action at the stop price but is cancelled if the position size exceeds the limit.

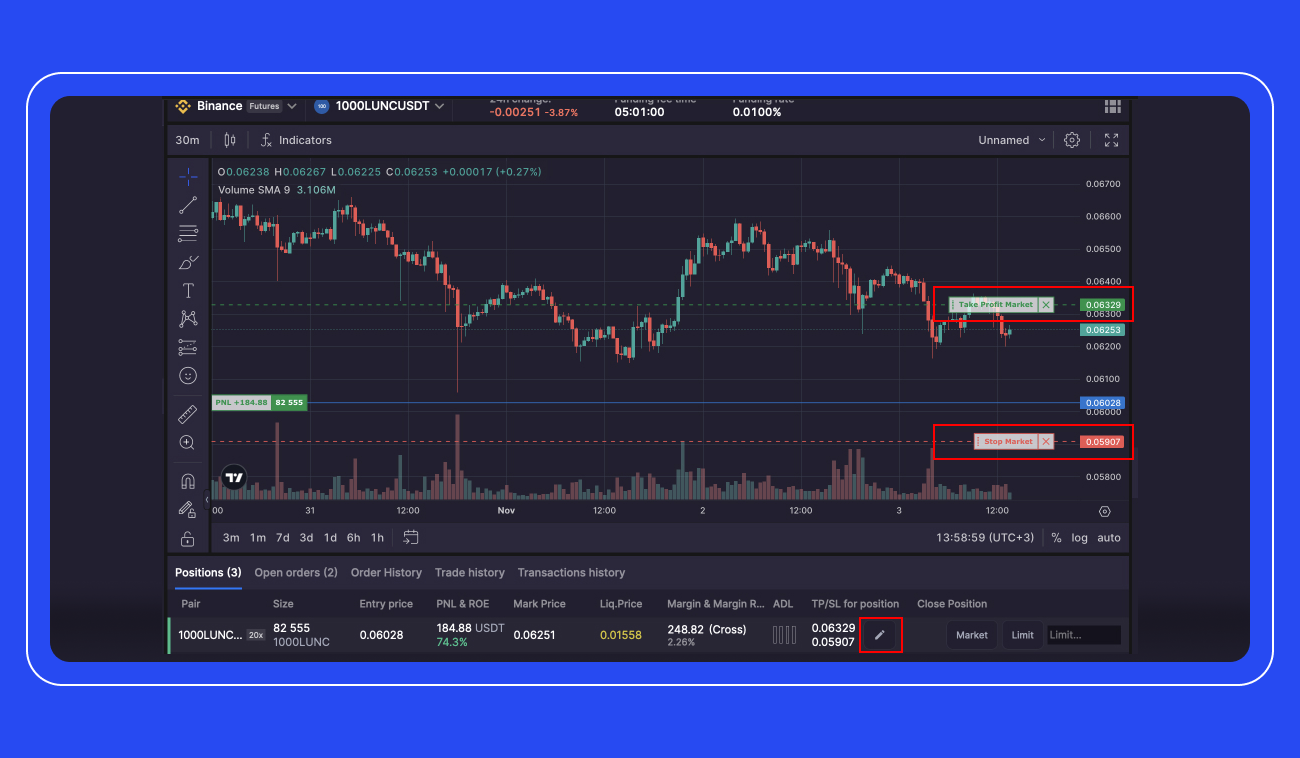

Voila! You're now a pro at setting TP/SL orders! But wait, there's more good news! You're not stuck with your initial settings — you can tweak them anytime you feel the need to fine-tune your trading strategy before the orders are executed.

Just click the [Pencil] icon in the TP/SL column for your order or drag and drop the TP/SL levels directly on the chart (Pic. 3). That's right! You're in full control of your trades.

Ready to give TP/SL for Futures a whirl? You’re welcome!

Bottom Line

There's a whole universe of strategies out there for deciding on your Take Profit and Stop Loss levels. The best part is, you get to play, experiment, and discover what works best for you. With Bitsgap, we've got you covered with paper trading modes for both spot and futures markets, allowing you to test run and experiment till your heart's content, all before you commit a single real dollar!

And hey, got a feature you wish we'd implement? Or perhaps you have other suggestions or comments on our work? We're all ears! Feel free to drop us a line right here → feedback.bitsgap.com. As you can see, we're always ready and eager to listen, and more importantly, make your ideas come to life!